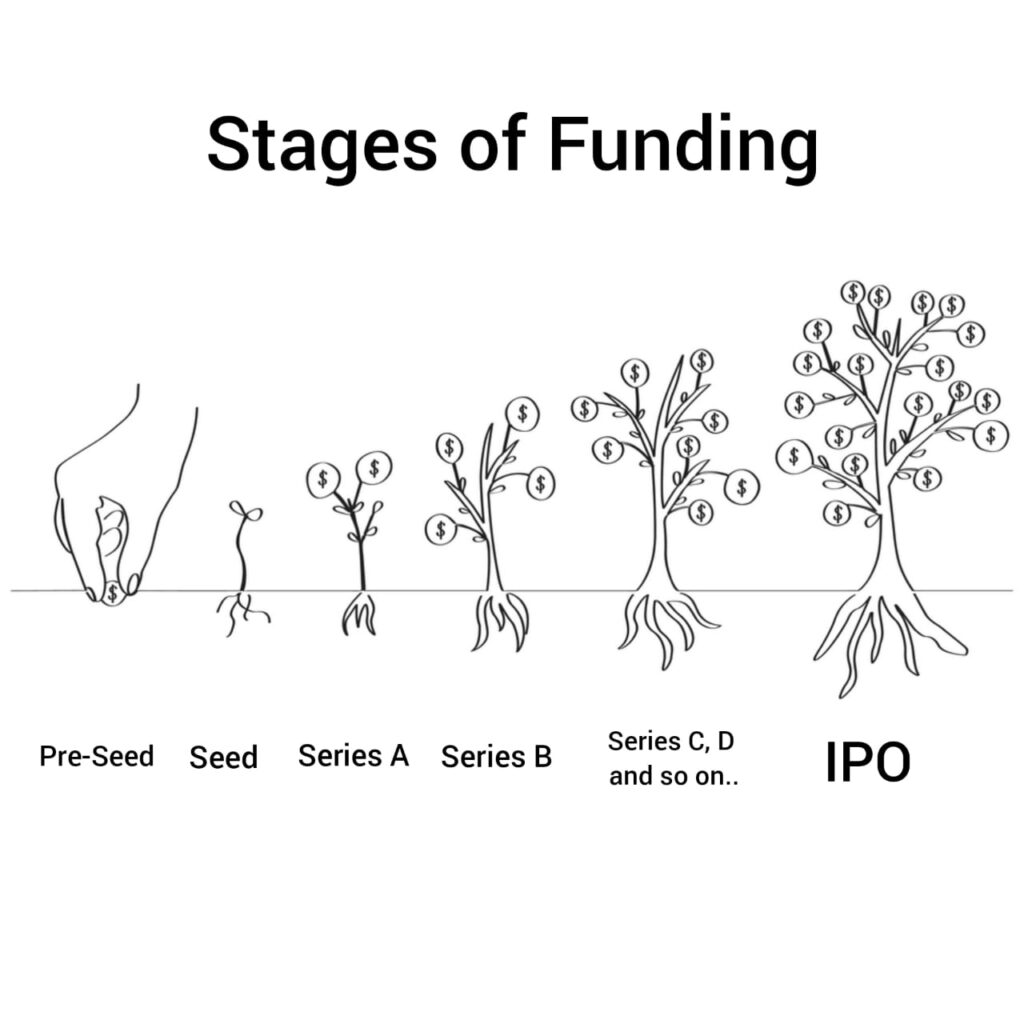

In the dynamic realm of entrepreneurship, securing funding stands as a critical milestone in the journey from idea to thriving business. Understanding the various stages of funding is paramount for startups seeking to navigate the complex landscape of financing. In this comprehensive guide, we delve into the different stages of funding, offering insights into each stage’s significance and nuances

Here are 13 different stages of funding.

- Seed Funding: Planting the Seeds of Innovation

The first and most basic stage of funding is called Seed Funding. Seed funding marks the embryonic stage of a startup’s journey. At this stage, entrepreneurs depend on their own savings, contributions from friends and family, or angel investors to kickstart their venture. Angel investors, frequently successful entrepreneurs themselves, furnish not only capital but also invaluable mentorship and industry insights. This initial injection of funds is pivotal for product development, market research, and constructing a prototype to attract additional investment.

- Angel Investment: Wings of Support for Early-Stage Ventures

As startups gain traction and demonstrate market potential, they often seek angel investors for additional capital. Angel investors, drawn to innovative ideas and disruptive technologies, inject funds into promising startups in exchange for equity. In contrast to traditional venture capitalists, angel investors are more inclined to take risks on early-stage ventures and actively participate in guiding the company’s growth trajectory.

- Series A Funding: Scaling Up with Institutional Investors

Series A funding represents a significant milestone in a startup’s journey. At this stage, venture capital firms, drawn by the promise of exponential growth, provide substantial funding to fuel expansion plans. Startups typically use Series A funding to ramp up marketing efforts, scale operations, and attract top talent. Securing Series A funding not only validates the startup’s business model but also opens doors to strategic partnerships and alliances.

- Series B Funding: Accelerating Growth and Market Penetration

With a proven track record and a growing customer base, startups embark on the next phase of financing: Series B funding. At this stage, venture capitalists inject substantial capital to fuel rapid growth, expand into new markets, and strengthen the company’s competitive position. In this financing empowers startups to allocate resources towards research and development, improve product offerings, and expand their sales and marketing initiatives.

- Series C Financing: Reaching New Peaks

Series C funding marks the pinnacle of a startup’s progression within the venture capital realm. By this stage, startups are often valued at hundreds of millions or even billions of dollars, prompting investors to infuse significant capital to expedite expansion and establish a firm grip on the market. Series C financing facilitates strategic acquisitions, global expansion initiatives, and groundwork for potential initial public offerings (IPOs)

- Venture Capital: Fueling Innovation and Disruption

Venture capital serves as a cornerstone for fostering innovation and bolstering economic expansion. Equipped with substantial resources and specialized knowledge, venture capitalists pinpoint promising startups and furnish the essential funding required to propel their advancement. Beyond monetary support, these investors furnish invaluable strategic counsel, facilitate networking connections, and open doors to prospective clientele and collaborators.

Also read : 10 Most commons mistakes while raising funds

- Private Equity: Unlocking Value in Established Businesses

While venture capital focuses on early-stage startups, private equity firms target more mature companies with proven business models and steady cash flows. Private equity investors acquire significant stakes in established businesses, often with the goal of driving operational efficiency, implementing strategic initiatives, and ultimately generating substantial returns on investment.

- Initial Public Offering (IPO): Going Public and Accessing Capital Markets

One of the most cherished stages of funding is an IPO. An IPO marks a pivotal moment in a company’s journey, transforming it from a privately held entity into a publicly traded company. By listing on a stock exchange, companies gain access to capital markets, enabling them to raise funds for expansion, repay debt, and provide liquidity to early investors. An IPO also enhances visibility, credibility, and brand recognition, paving the way for future growth opportunities.

- Crowdfunding: Democratising Access to Capital

In the digital age, crowdfunding platforms have emerged as a popular alternative to traditional forms of financing. Entrepreneurs leverage crowdfunding to raise capital from a diverse pool of investors, often in exchange for rewards, equity, or debt. Crowdfunding democratizes access to capital, allowing startups to validate their ideas, build a community of supporters, and test the market demand for their products or services.

- Bootstrapping: Building a Business from the Ground Up

In some cases, entrepreneurs opt to bootstrap their ventures, relying on their own resources and revenue generated from early sales to fund growth. Bootstrapping fosters a culture of frugality, resourcefulness, and resilience, as entrepreneurs learn to prioritize spending, innovate with limited resources, and focus on generating sustainable cash flows.

- Accelerator and Incubator Programs: Nurturing Startup Ecosystems

Accelerator and incubator programs play a crucial role in nurturing and supporting early-stage startups. These programs provide mentorship, resources, and networking opportunities to help startups navigate the challenges of building a successful business. By fostering collaboration, knowledge sharing, and innovation, accelerators and incubators contribute to the growth and vibrancy of the startup ecosystem.

- Pre-Seed Funding and Bridge Financing: Filling the Funding Gap

Pre-seed funding and bridge financing address the funding gap between initial concept validation and subsequent rounds of financing. This style of funding provides entrepreneurs with the necessary capital to develop a prototype, conduct market research, and validate their business model. Bridge financing, on the other hand, offers short-term funding to bridge the gap between two financing rounds or to support a startup through a challenging period.

- Mezzanine Financing: Striking a Balance Between Risk and Reward

Holds a distinctive place within the capital hierarchy the Mezzanine financing is providing a hybrid of debt and equity funding tailored for rapidly expanding enterprises. Mezzanine lenders extend financial support through subordinate debt, convertible instruments, or preferred equity, typically offering enhanced returns adjusted for risk. This form of financing empowers companies to secure supplementary capital while preserving the ownership interests of current shareholders.

In conclusion, navigating through different stages of funding requires entrepreneurs to be strategic, resourceful, and resilient. By understanding the different stages of financing and leveraging the diverse avenues available, startups can secure the capital they need to fuel growth, drive innovation, and realize their full potential in the competitive business landscape. Whether it’s seed funding from angel investors, venture capital funding for rapid expansion, or an IPO to access capital markets, each stage of financing represents a critical milestone on the journey to entrepreneurial success.

One thought on “Startup Financing: Exploring Stages of funding”